0

M+

Verification

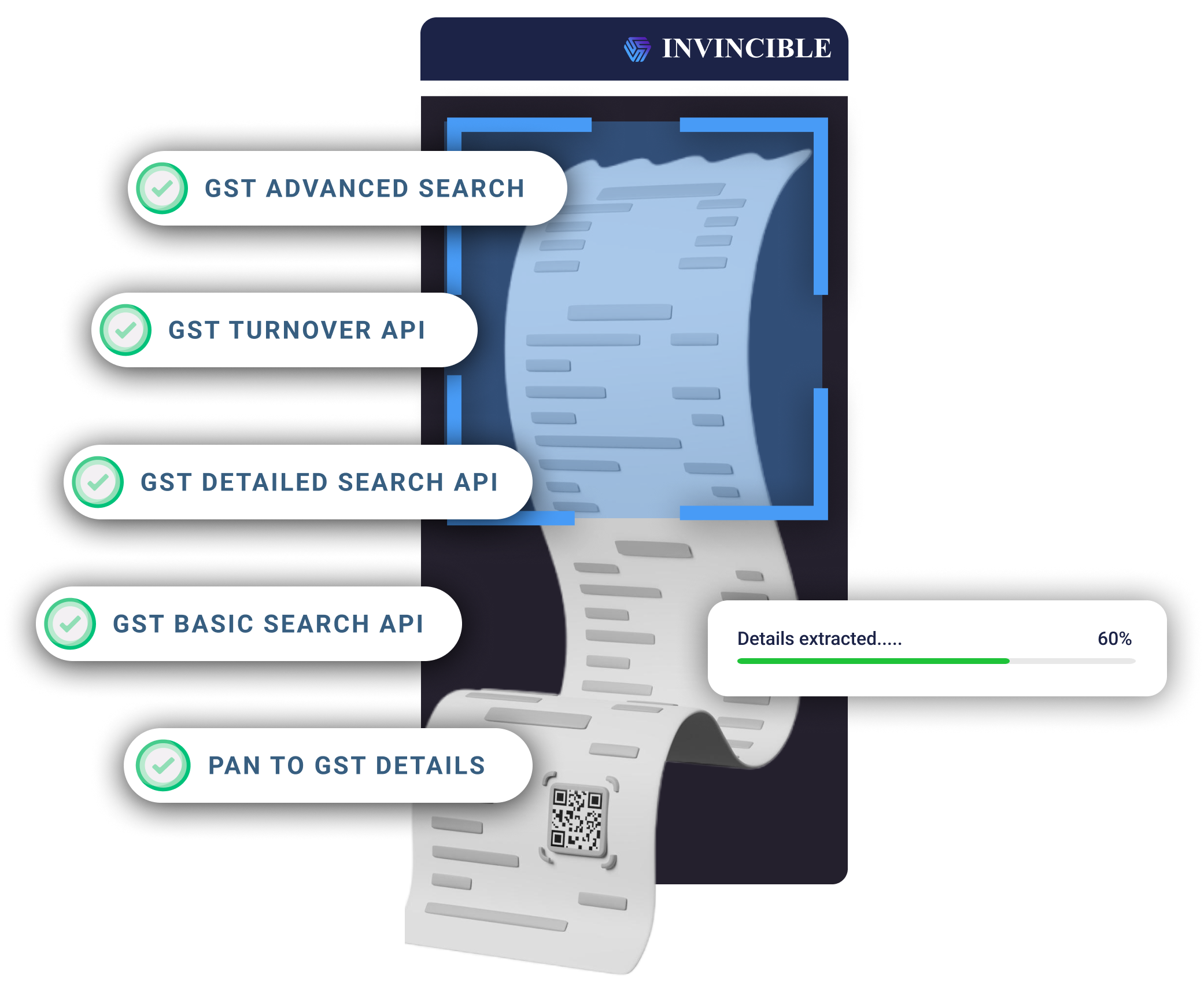

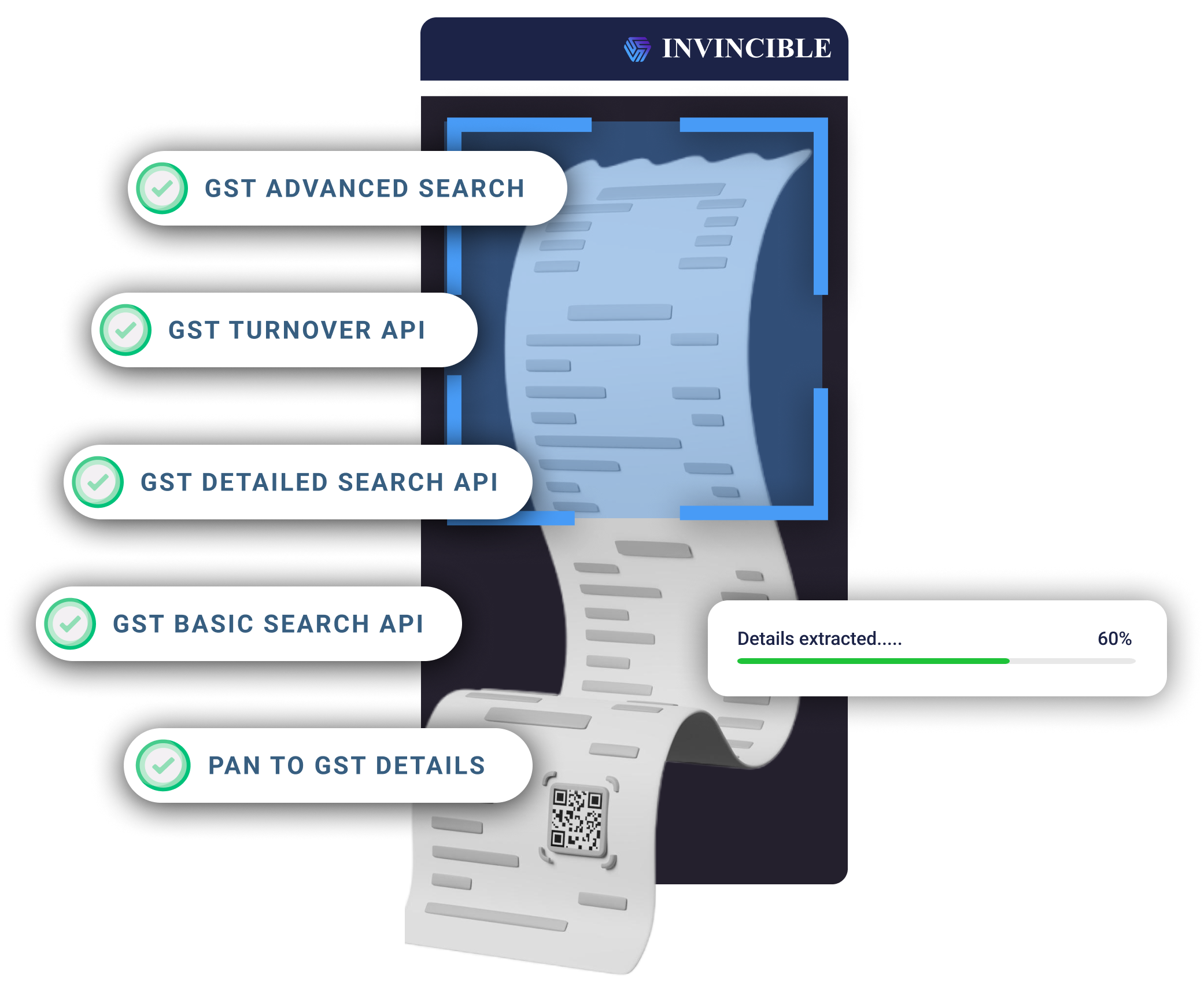

GST Verification API

- GST Detailed Search API

- View and Track Returns

- GST Verification with OTP

- Fetch GST R1, R2, 3B Details

- Track GST Turnover and Gross profit

- GST Public Search API

The API Is Straightforward And Integration Is Effortless, We Provide A Simple And User-Friendly Interface.

The Process Will Save Any Institution That Has Been And Can Be A Victim Of Fake Vehicle Holders. With Invincible Ocean’ S Chassis Number To Vehicle RC API Will Easily Avoid Such Frauds.

Our System Checks The Information From The RTO Department. Therefore, The Results Are Always Correct And Legit.

Goods and Services Tax Network (GSTN) API allows fetching taxpayer details using the GST Identification Number (GSTIN).

Get detailed info, including address, firm name, and view and track returns.

Get complete information on GST R1, R2, and 3B details, including turnover and profit/loss.

Related to GST Verification API

The Vehicle RC Verification API is a software interface that allows developers and businesses to programmatically verify and authenticate vehicle Registration Certificates (RC) using an automated process.

You can use the API to validate the authenticity of vehicle RC documents, check vehicle details such as ownership, registration status, make, model, and other relevant information.

The GST Detailed Search API enables users to perform comprehensive searches on GST-related information. It provides detailed data on GST registrations, filing statuses, and other relevant information, helping businesses maintain accurate records and ensure compliance.

The View and Track Returns feature allows users to monitor the status of their GST returns. It provides updates on the filing status, due dates, and any discrepancies that may arise, ensuring timely and accurate GST return submissions.

GST Verification with OTP (One-Time Password) adds an extra layer of security by requiring an OTP to verify GST numbers. This ensures that only authorized users can perform the verification, reducing the risk of unauthorized access and potential misuse.

The Fetch GST R1, R2, 3B Details API allows users to retrieve detailed information from their GST R1, R2, and 3B forms. This includes data on sales, purchases, and tax credits, providing a comprehensive view of GST filings and aiding in accurate tax reporting.

The Track GST Turnover and Gross Profit feature helps businesses monitor their financial performance by tracking GST turnover and calculating gross profit. This information is crucial for financial planning, budgeting, and ensuring compliance with GST regulations.